http://fundontology.com/fr/rule/Rules_Investment_Adviser_Act.ttl#Exempted_Ex_USC_s80b_3_b_4_B_charity_fund_80a_3c_10_B

Class 'fr-rule-iaa:Exempted ex. USC § 80b–3 (b) (4) (B) - Charitable fund'

rdf:type

-

|

owl:Class |

|

rdfs:comment

-

|

This assumes that the investors are already asserted as Non-Profits in the FIBO load.

|

|

rdfs:label

-

|

Exempted ex. USC § 80b–3 (b) (4) (B) - Charitable fund

|

|

rdfs:subClassOf

-

|

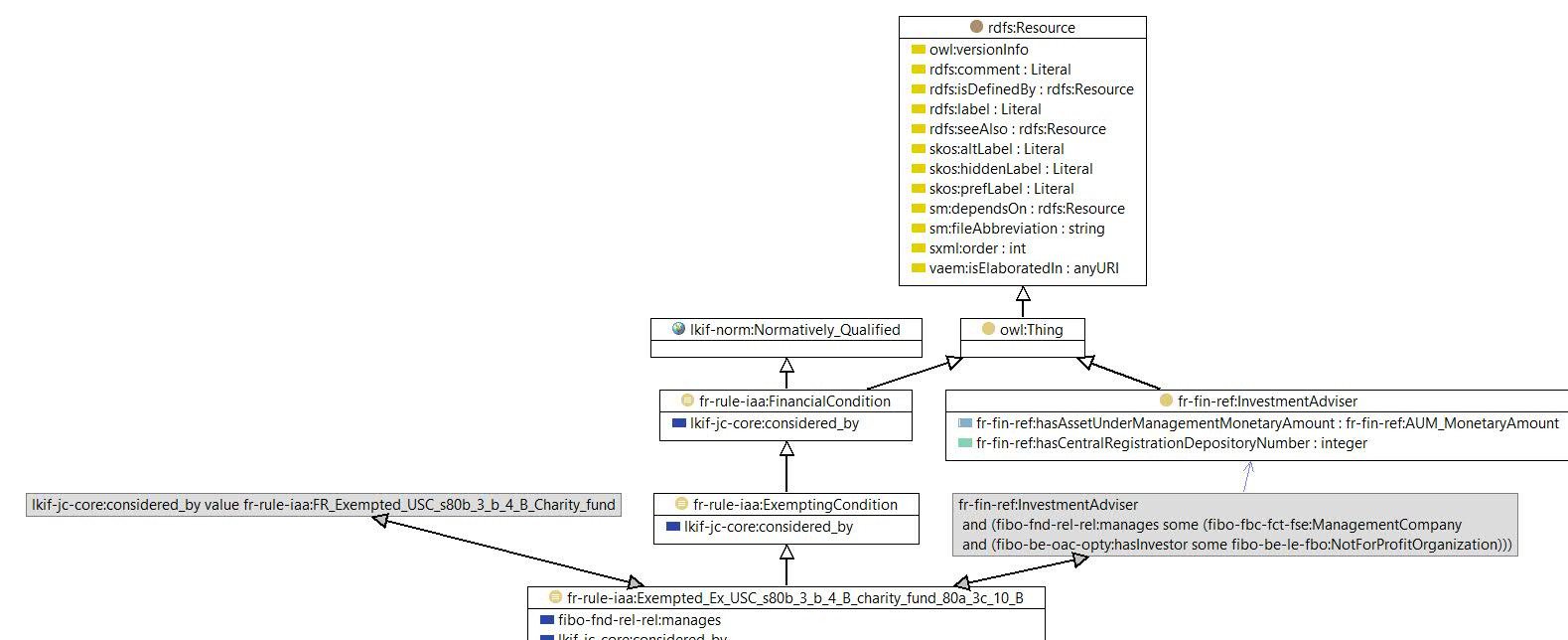

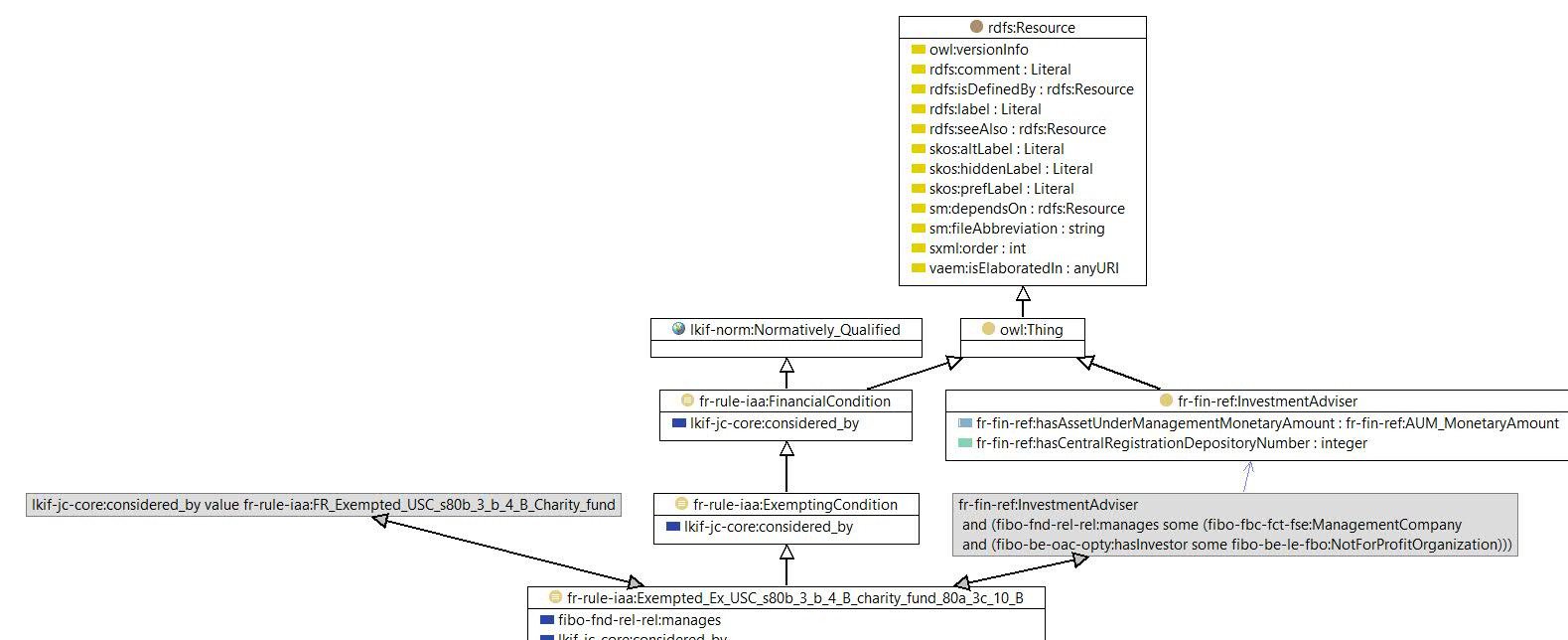

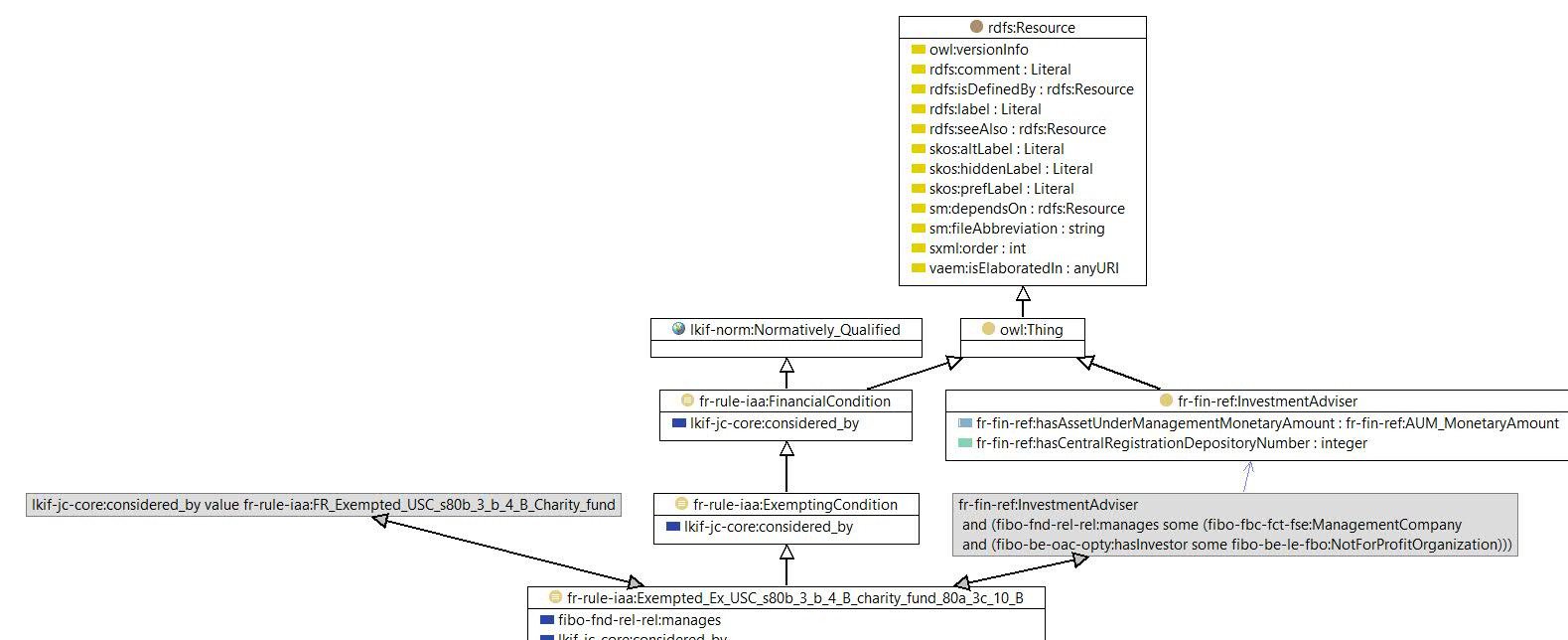

owl:equivalentClass

-

-

|

fr-fin-ref:Investment Adviser

and (fibo-fnd-rel-rel:manages some (fibo-fbc-fct-fse:ManagementCompany

and (fibo-be-oac-opty:hasInvestor some fibo-be-le-fbo:NotForProfitOrganization)))

|

|

skos:definition

-

|

An defined class for FIBO Functional Business Entities that are exempted from Securities & Exchange Commission registration under U.S. Code § 80b–3 (b) (4) : “any investment adviser that is a charitable organization, as defined in section 3(c)(10)(D) of the Investment Company Act...".

(B) "a fund that is excluded from the definition of an investment company under section 3(c)(10)(B) of the Investment Company Act of 1940 [15 U.S.C. 80a–3 (c)(10)(B)];"

The equivalent class simply consits of all FIBO Investment Advisers that manage funds with FIBO Non-Profits as investors.

|

|

© 2016

Jayzed Data Models Inc. generated with TopBraid Composer

back to Hedge Fund Ontology or

documentation index