The Hedge Fund Regulation Ontology is an operational application of the Financial Regulation Ontology.

Semantic Compliance® is an ontological approach to regulatory reporting and oversight.

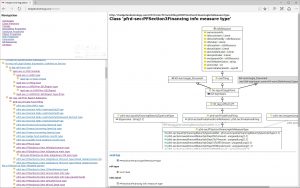

The ontology defines semantic rules to process regulatory compliance forms. The purpose is operational for:

- Hedge Funds under the supervision of the Securities and Exchange Commission must complete Form PF (private fund).

- Regulators to extract Form PF filing data, transform and load it into semantic data structures.

The Semantic Web is a World Wide Web Consortium (W3C) extension of the conventional Web.

The standards promote common data formats and exchange protocols on the Web, most fundamentally RDF, the Resource Description Framework. In RDF everything is a triple of subject-predicate-object.

Ontology Web Language (OWL) standard extends RDF with semantics for classes, properties, and individuals. Beyond web applications, the semantic technology stack includes RDF database systems, SPARQL query language, inference, and rules engine.

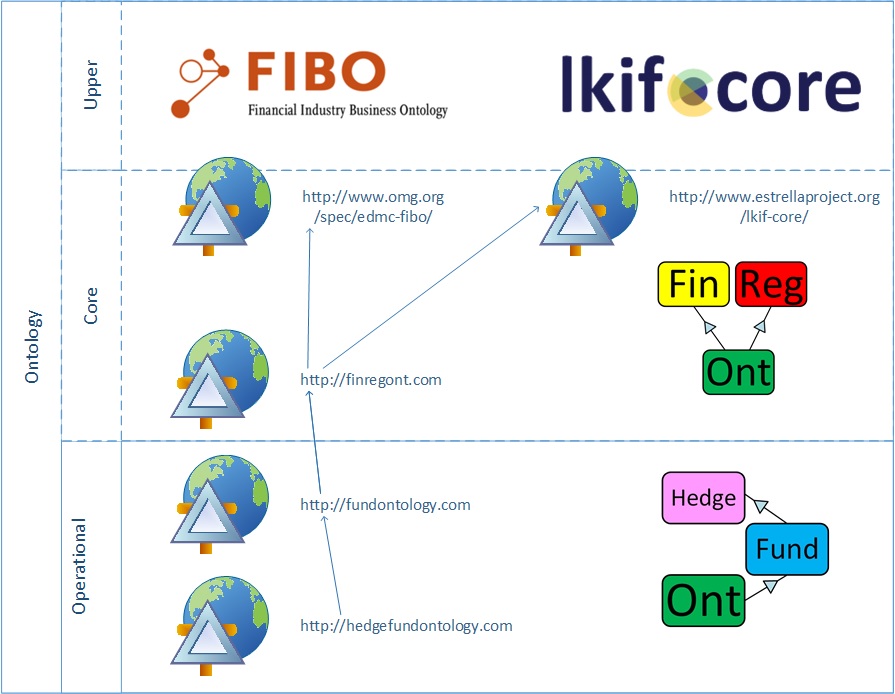

Hedge Fund Compliance crosses the domains of Finance and Legal.

The Hedge Fund ontology imports, aligns, and extends the dominant reference ontologies:

- The Financial Industry Business Ontology (FIBO) is a collaboration between the Enterprise Data Management Council and the Object Management Group.

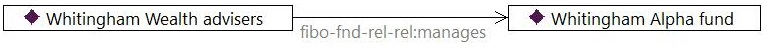

FIBO holds the Fund’s reference data and financial information. - The Legal Knowledge Interchange Format (LKIF), a European Union project models legal rules of the kind found in legislation and regulations.

LKIF holds the legislative context, text of laws and regulations, and legal forms.

Hedge Fund, Fund, and Financial Regulation Ontology rules connect the domains. They evaluate FIBO financial data to implement a regulatory requirement from LKIF.

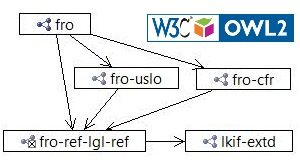

This website is the publishing location for the Hedge Fund ontology files and provides the namespace for the resources. The diagram shows the family of modules for Financial Regulation Ontology.

Fund Ontology covers regulations common for all investment vehicles. The ontology contains form ADV (investment advisers). A set of rules determines SEC registration and filing requirements.

Financial Regulation Ontology is the higher level, a core ontology for all financial service providers. The ontology contains the text of:

- United States Code Title 15, Chapter 275 Investment Companies and Advisers

- Code of Federal Regulations Title 17, Chapter II Securities and Exchange Commission, Part 275 Rules and Regulations of the Investment Adviser Act

Semantic compliance is not an out-of-the-box piece of software. It is a new standards-based approach and methodology. All ontologies are Open Source with free MIT/GPL public license. Data and meta data management are part of the ontology. Requirements, models, mapping, lineage, business rules, everything expressed in RDF/OWL. Everything is a Triple.

To learn more: Implementing Financial Regulation Ontology tutorial on FinRegOnt, ontology documentation and OWL files on this site.